Ghanaian startups span many niches including mobile wallets to cross-border payments, insurance, credit apps and even blockchain remittance.

Finance Startups in Ghana to Watch in 2025

Ghana’s finance scene is burgeoning. From the busy mobile-money stands to tech hubs spread over the regions, startups are using smartphones, blockchain and AI to reshape how people manage money.

Over 70 fintech companies now operate here, and the Bank of Ghana’s strict licensing means only the most secure and innovative survive. MTN Mobile Money (also branded as MoMo) dominates with about 89.3% of Ghana’s mobile-finance revenue, a strong sign both of MoMo’s ubiquity and the giant opportunity for challengers. Meanwhile the Bank of Ghana is even making plans to launch a national digital currency (“e-Cedi”) in 2025 to reach rural, offline populations.

Ghanaian startups span many niches including mobile wallets to cross-border payments, insurance, credit apps and even blockchain remittance. Ghanaian tech leaders are charting the trends.

Here are some players and trends behind the innovation in Ghana’s finance landscape.

Mobile Wallets & Payments

The staples are familiar. In addition to MTN MoMo, the government-backed GhanaPay (by GhIPSS) is rolling out a bank-linked mobile wallet, letting customers send and receive money and pay bills across networks. Private platforms like ExpressPay, and PaySwitch power bill payments and merchant payments.

For instance, ExpressPay’s app lets users top up airtime, pay utilities and even send money abroad efficiently.

HubTel goes further by bundling payments with e-commerce tools and even bulk SMS, helping small businesses digitize sales. And new all-in-one apps like Kowri (by DreamOval/Sevn) promise banking, credit, bill-pay and insurance in one place for the Ghanaian middle class.

Cross-Border & Crypto Remittances

Connecting Ghana to the world is big. Fintechs like ZeePay specialize in instant remittances. They settle foreign transfers straight into African mobile wallets. ZeePay (founded 2014) now operates in 20+ countries and handled over 10 million transactions worth $3+ billion in 2023.

Crypto startups also play a role. Bitsika Africa lets Ghanaians send USDT-based payments quickly. In 2020 Bitsika reported processing nearly $40 million in crypto remittances, up 3,900% year-on-year!. These tools help diaspora or business payments bypass traditional FX hassles. In fact, Ghana’s total annual remittances top $2–3 billion, so any faster, cheaper money app will find eager users.

There are also honorable mentions like YellowCard

Lending & Credit (AI-driven)

Many Ghanaians lack bank credit, so mobile lending apps are surging. A standout is Fido, a sort of “mini super app” that offers instant loans, savings and phone financing.

Fido’s AI-powered Fido Score underwrites loans without collateral, and it has disbursed over $500 million to 1+ million users so far. In September 2024 Fido closed a new $30 million funding round to expand regionally.

The Fido success shows the potential of AI’s impact. AI offers better risk models meaning more people (even informal workers or the unbanked) can get credit. Other platforms like Oze focus on SMEs by providing bookkeeping tools and collateral-free loans for small businesses , but the same digital lending trend is reaching individuals through payroll apps and micro-loans.

AI Personal Finance & Investing

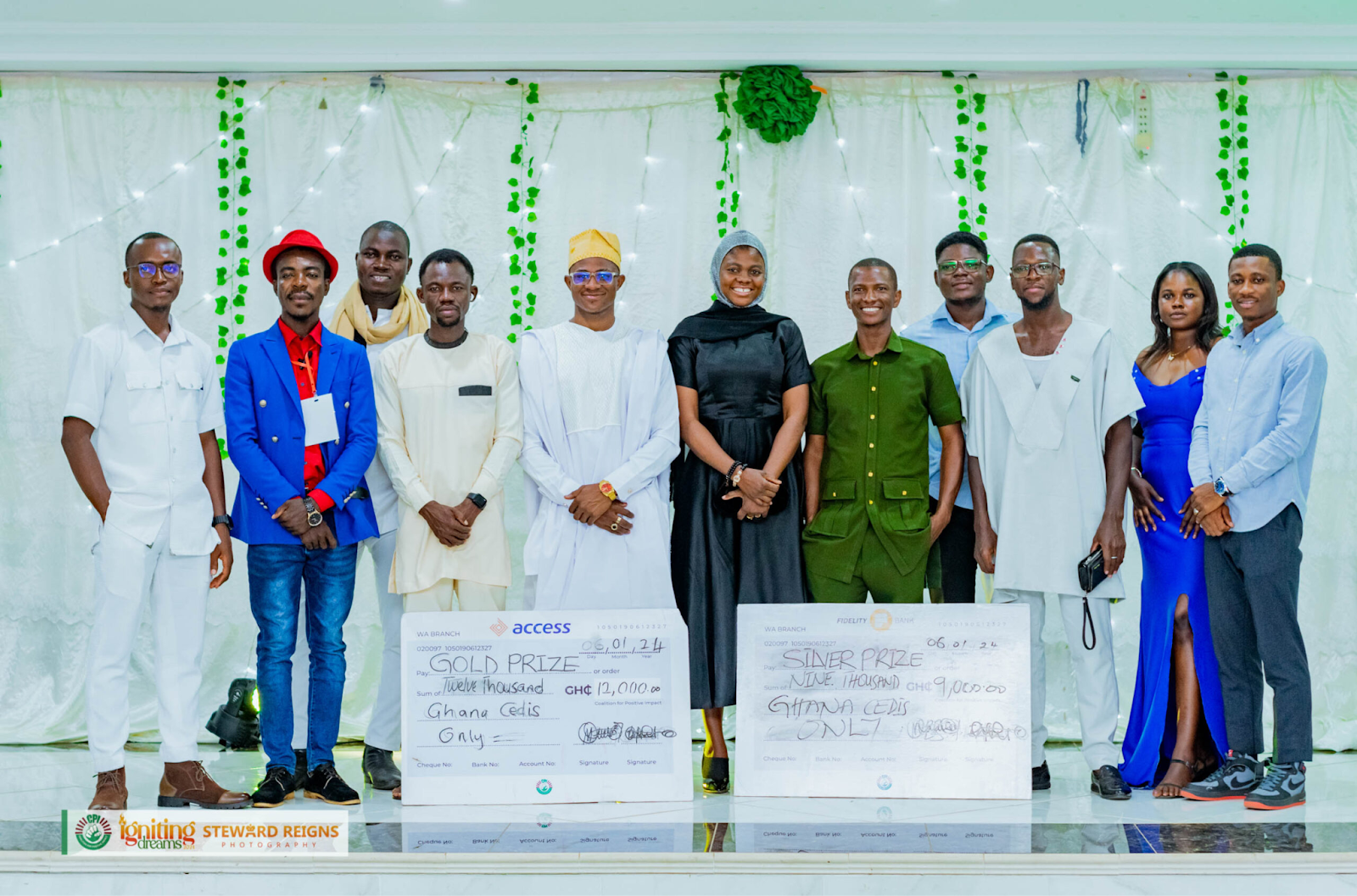

Fintech is getting “wise” about wallets. A hot newcomer is Ladder (ladder.africa), an AI-powered wealth app. Ladder’s chatbot “LADY” gives personalized budgeting and investment advice, from awareness driven retirement tips to investment strategy stock recommendations. Through AI, these are all based on each user’s goals. It also offers dollar-linked savings and even treasury-bill investments, letting Ghanaians put their cedis into US assets. In 2024 Ladder won Ghana Fintech Startup of the Year for exactly this kind of innovation. By blending expense tracking with goals and investment options, platforms like Ladder aim to make Ghanaians into smarter savers/investors, not just digital shoppers.

Blockchain & Microfinance

Ghana’s techies love blockchain. Besides Bitsika (crypto remittances), there’s Mazzuma, a Ghana-based startup using AI and blockchain in its mobile wallet. Mazzuma’s platform lets developers integrate crypto payments (it boasts an API that hooked up 10,000+ e-commerce stores and handled over $140 million in payments). The goal is inclusion: 400,000+ Ghanaians already use Mazzuma to send/receive money and pay for services. These crypto rails can reduce remittance costs and even enable new loans via tokenized collateral in the future.

Crowdfunding & Community Finance

Startups are also tackling group savings and giving. Chango is a crowdfunding app for small communities (church groups, clubs, charities) to raise funds together. Users create groups, invite friends, then collect and track contributions via mobile money or cards. Such platforms help Ghanaians crowd-fund school fees, medical bills or community projects without bureaucratic NGOs, making finance more peer-to-peer.

Insurance & Impact

While still emerging, Ghana’s insurtech scene is growing. Traditional microinsurance pioneer MicroEnsure Ghana (now part of Kenya’s Turaco) sold mobile insurance via telcos to millions of low-income Ghanaians. Going forward, new entrants (both local and regional) aim to offer affordable crop, health or life insurance via mobile apps. For instance, global players like Turaco are already integrating with telcos and banks to distribute policies easily. These services have a huge social impact in Ghana, where many can’t afford conventional insurance.

Challenges & Opportunities

Despite all the noise that AI, Crypto and Fintech tend to draw, Ghana’s startups scene has maintained some level of composure in the tricky terrain. Strict regulation means long approval processes, but it also builds trust.

High mobile penetration (over 100%) and growing smartphone use (about 70% internet coverage) are massive tailwinds. Yet competition is fierce. MoMo, Vodafone Cash and banks still grab much of the market share.

Historic Currency volatility and inflation (the recent cedi appreciation is against the tide) can complicate things like savings or pricing. And beyond urban areas, spotty internet and digital-literacy gaps remain.

On the flip side, Ghana’s young, tech-hungry population and diaspora (remitting ~$2–3B/year) offer a huge customer base. Launching the e-Cedi CBDC (with offline capability) could leapfrog access in villages. Plus, annual Fintech Awards, innovation hubs and even government partnerships are spurring more collaboration.

Ghana’s finance startups are turning personal finance into an exciting frontier. From turning phones into wallets and credit portals, to using AI bots for budgeting and blockchain for cross-border pay, these innovators are giving everyday Ghanaians more control over money. Ghana’s saying ‘Let the cedi go digital’ and startups are leading the charge!”

Subscribe to MDBrief

Clean insights, a bit of sarcasm, and zero boring headlines.