The most lucrative avenue for many Ghanaian influencers is brand sponsorships.

Monetization Models: How Ghanaian Creators Earn a Living

Monetization is the crux of the creator economy – turning content and audience attention into income. Ghanaian digital creators employ a variety of monetization models, often combining multiple streams to sustain their work. The main revenue channels include:

- Advertising Revenue (Ad Monetization): For video creators, platforms like YouTube offer a share of advertising revenue via the YouTube Partner Program. Once a creator meets the threshold (e.g. 1,000 subscribers and 4,000 watch hours), they can earn money from ads displayed on their videos. Many Ghanaian YouTubers are part of this program, though earnings per view are relatively low due to regional ad rates. (Notably, ad payouts for African creators can be significantly lower – TikTok, for example, reportedly pays African creators about 40% less than U.S. creators for similar content, and YouTube’s ad CPM in Ghana is generally a fraction of Western markets.) Still, for top YouTubers with hundreds of thousands of views, these payouts add up. In addition to YouTube, some bloggers and online publications use Google AdSense or direct banner ads to monetize web traffic. However, Ghana’s local digital ad market is small, so creators relying on pure ad revenue face limitations unless they tap into a global audience. This is why many supplement with other income sources.

- Brand Sponsorships and Paid Partnerships: The most lucrative avenue for many Ghanaian influencers is brand sponsorships. This involves companies paying creators to promote products or services on their channels – through dedicated posts, shout-outs, product reviews, or ongoing brand ambassadorship. In Ghana, telecommunications, consumer electronics, fashion/beauty, and beverage brands are among the frequent collaborators. Creators like Jessica Opare-Saforo have partnered with both local and international brands (e.g. a local bank for a financial literacy campaign, or a tech company sponsoring a gadget review). Even skit comedians are approached by brands to incorporate products humorously into their viral videos. As the influencer marketing industry matures, brands are becoming more value-conscious – focusing on creators who can deliver actual engagement or sales. Sponsored content on Instagram and TikTok is especially common; influencers usually disclose these as “#ad” or “partnered” posts (though enforcement of disclosure is lax in Ghana, as discussed under Policy). Sponsorship deals can range from one-off freebies (micro-influencers might get a free meal to post about a restaurant) to significant contracts (macro-influencers securing multi-month deals worth thousands of cedis). For many creators, a few steady brand partnerships form the backbone of their income.

- Affiliate Marketing and Referral Links: A smaller but growing monetization method is affiliate marketing, where creators earn a commission for driving sales or traffic to an online retailer via special links or codes. Some tech reviewers and fashion influencers in Ghana use affiliate links for products on global sites (like Amazon) or local e-commerce platforms (like Jumia Ghana). For instance, a YouTuber reviewing smartphones might include an Amazon affiliate link for viewers abroad, or a beauty influencer might share a discount code for a local makeup store and receive a cut of referred sales. While affiliate earnings in Ghana are generally modest (due to lower e-commerce usage compared to Western countries), it’s an easy addition to a creator’s income stream. It also encourages influencers to be more entrepreneurial, essentially acting as sales partners for brands. As e-commerce and online shopping grow in Ghana, affiliate marketing could become more significant.

- Merchandise and Direct Product Sales: Many creators leverage their personal brand to sell merchandise or their own products. This ranges from simple merch – branded T-shirts, caps, mugs with a creator’s logo or slogans – to fully developed product lines (such as a fashion capsule collection or cosmetics line). For example, Kwadwo Sheldon sells T-shirts with his catchphrases to fans, providing an extra revenue source beyond content. Some creators have gone further: the team behind the popular youth brand Free The Youth started by creating viral street-style content on Instagram and then launched their own streetwear apparel, which is now a successful business. As noted, Ama Burland uses her online influence to drive sales for her Diya Beauty skincare products and salon services. These examples show creators turning their influence into entrepreneurship – essentially becoming social-powered small businesses. Platforms like Shopify, Flutterwave Store, or even Instagram Shopping tools have made it simpler for Ghanaian creators to set up online stores. According to one report, artists and creators in Ghana can use fintech platforms like Flutterwave to create online shops or payment links, allowing their audience to pay them directly for goods or services.

- Fan Donations, Memberships, and Subscriptions: Another monetization model is getting direct support from one’s audience. Globally, this is done via platforms like Patreon, YouTube Channel Memberships, Twitch subscriptions, or buying “stars” and virtual gifts on live streams. In Ghana, access to some of these features is limited – for example, TikTok’s tipping feature is officially limited to the US, and YouTube’s Memberships or SuperChat tipping require creators to have specific account statuses. Moreover, Ghana’s absence on PayPal’s supported countries list historically made it hard to use Patreon (which pays out via PayPal). Despite these barriers, some Ghanaian creators have found ways to earn from fans:

- Mobile Money Tips: It is common for creators to share their Mobile Money number (MTN Mobile Money is ubiquitous in Ghana) for fans who wish to “appreciate” their work. For instance, during a Facebook or Instagram Live session, a comedian might display their MoMo number so that appreciative viewers can send small monetary tips. This is a grassroots solution to the lack of integrated tipping tools.

- YouTube Live and Stars: Facebook’s Stars (a feature to tip creators during live videos) and YouTube’s Super Chat have been rolled out in some African regions. A few Ghanaian gaming streamers or entertainers who go live might receive such virtual gifts which convert to earnings.

- Exclusive Content Memberships: While not widespread yet, a couple of Ghanaian creators have experimented with offering exclusive content to paying subscribers. For example, a fitness influencer might have a premium Telegram or WhatsApp group for paid members who get personalized coaching. As global platforms expand creator monetization (Instagram’s fan subscriptions, Twitter’s Super Follows, etc.), Ghanaian creators will likely adopt these where possible.

- Mobile Money Tips: It is common for creators to share their Mobile Money number (MTN Mobile Money is ubiquitous in Ghana) for fans who wish to “appreciate” their work. For instance, during a Facebook or Instagram Live session, a comedian might display their MoMo number so that appreciative viewers can send small monetary tips. This is a grassroots solution to the lack of integrated tipping tools.

- Overall, direct audience monetization is still nascent and usually constitutes a small portion of income for Ghanaian creators. Most fans are used to free content and not yet in the habit of paying for digital content. But those with very loyal fanbases have an opportunity to cultivate this model moving forward.

- Creator Funds and Grants: On-platform creator funds (pools of money set aside by platforms to pay creators based on views/engagement) have not significantly reached Ghana yet, as they are often region-restricted. For instance, TikTok’s Creator Fund launched in 2020 was geared mostly towards US and Europe, meaning Ghanaian TikTokers don’t benefit from it directly. However, there have been some initiatives targeting African creators:

- In 2022, YouTube’s Black Voices Fund included some Ghanaian YouTubers, providing funding and training to amplify underrepresented Black creators.

- Spotify’s Africa Podcast Fund in 2022 awarded $100,000 to support emerging podcasters in Africa, including a couple of Ghanaian podcasts. This helped those creators improve production and indirectly monetize through the grant.

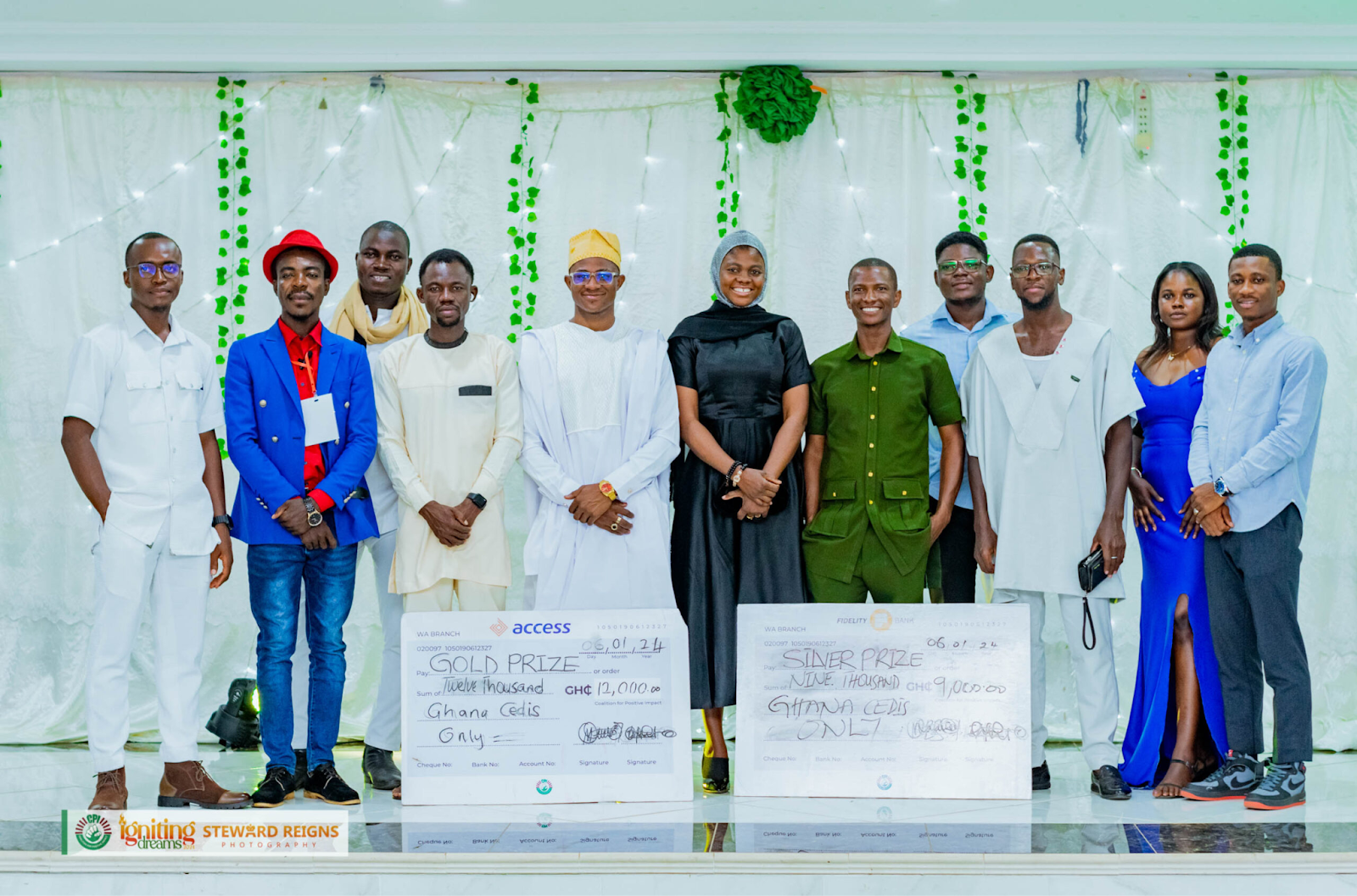

- Occasionally, local telecom or media companies host contests and cash prizes for viral content (for example, MTN’s Shortz contest a few years back rewarded short mobile videos).

- In 2022, YouTube’s Black Voices Fund included some Ghanaian YouTubers, providing funding and training to amplify underrepresented Black creators.

- While these funds and contests are not a steady revenue model, they are worth noting as part of the monetization mix. They signal that global tech companies are beginning to invest in African content creation, albeit on a limited scale. Ghanaian creators keep an eye out for such opportunities to supplement their income and gain exposure.

- Offline Events and Spin-off Opportunities: A creator’s influence often extends beyond the screen, unlocking offline income opportunities:

- Paid Appearances and Hosting: Popular influencers are sometimes hired to host events, appear at product launches, or MC concerts, thanks to their public appeal. For example, a comedian who gained fame on YouTube might be booked (for a fee) to perform stand-up at a corporate event or become an event hype-man.

- Workshops and Consultation: Creators with expertise might run training workshops (e.g. a photography vlogger teaching a paid class on mobile photography) or consult for businesses (a social media guru advising a company’s digital strategy).

- Media Deals: A few digital stars have transitioned into traditional media gigs – a TikTok star getting a role on a TV show, or a Twitter influencer being hired as a radio presenter – which then provide a salary or contract pay. This crossover can be seen as monetizing their personal brand in a new format.

- Live Shows: Content creators in comedy and music sometimes put together live shows. For instance, a comedy skit group on Instagram might organize a live comedy night and sell tickets, leveraging their online following. Similarly, YouTube musicians or spoken-word artists often hold shows or perform at festivals, monetizing through ticket sales or performance fees.

- Paid Appearances and Hosting: Popular influencers are sometimes hired to host events, appear at product launches, or MC concerts, thanks to their public appeal. For example, a comedian who gained fame on YouTube might be booked (for a fee) to perform stand-up at a corporate event or become an event hype-man.

In essence, Ghanaian creators monetize through a patchwork of streams. Ad revenues alone are rarely enough to live on (due to the relatively low ad spend in the region), so creators become savvy entrepreneurs – mixing brand partnerships, selling their own products, offering services, and tapping into any available fund or fan support. This diversification is crucial: for example, when YouTube ad rates fluctuate or an algorithm change reduces views, those with alternate income (merch, sponsorships, etc.) can better withstand the shocks. As the creator economy matures, we see innovative models emerging, like social commerce (integrating storefronts into social profiles) and collaborative monetization (creators forming teams or production houses to maximize earnings).

Notably, most content creators in Ghana still rely on Mobile Money for receiving payments from brands or fans, as it’s a widely adopted financial tool. A brand paying a micro-influencer for a few Instagram posts might simply send Mobile Money to their phone number – a quick and easy transaction in the local context. This use of existing mobile payment infrastructure is a clever workaround for the absence of global payment platforms (like PayPal) and underscores how local technology is adapted for the creator business.

Audience Demographics and Cultural Trends

Understanding the audience is key to analyzing the creator economy. In Ghana, audience demographics and behaviors are shaped by the country’s youthful population, regional differences, and cultural nuances that influence content consumption.

Youthful, Mobile-First Audience: Ghana’s population is very young – the median age is around 20.8 years, and roughly two-thirds of the population is under 30. This means the core audience for digital content is predominantly Gen Z and young millennials. These young people are often mobile-first internet users, accessing social media via smartphones rather than desktop computers. They have grown up with social apps and are quick to adopt new platforms (which explains TikTok’s rapid rise). This demographic leans toward visual, entertaining content – hence the popularity of comedy, music, dance, and fashion content. They also form the bulk of followings for influencers on Instagram, TikTok, and YouTube.

Urban vs. Rural Dynamics: Ghana’s internet penetration is much higher in urban areas, especially Greater Accra and other cities like Kumasi, Takoradi, and Tamale. About 59.5% of Ghana’s population lives in urban areas (where network infrastructure is better), so these areas dominate online content creation and viewership. Greater Accra Region (which includes the capital Accra and surrounding towns) is the epicenter – it has the highest concentration of both creators and consumers. Many top influencers are based in Accra, giving them proximity to brands and high-speed internet. Accra’s youth are trendsetters, often the first to latch onto global memes or start local trends that then spread nationwide via social media.

In contrast, users in smaller towns or rural regions are coming online more gradually, usually via cheaper Android smartphones and expanding 3G/4G networks. While the overall numbers are lower, their engagement can be significant when content is tailored to them (e.g. videos in local languages). For instance, there are popular Facebook pages and YouTube channels that deliver news and comedy in languages like Twi, Ewe, or Dagbani, resonating strongly within those linguistic communities. Regional content (like a Northern Ghana vlogger showcasing life in Tamale, or a Kumasi-based TikToker doing skits in Asante Twi) helps bridge the urban-rural digital gap. Yet, Greater Accra remains the hub where most monetization and influencer marketing opportunities concentrate, which sometimes leads creators from other regions to relocate or spend significant time in Accra to grow their careers.

Platform Preferences and Usage Patterns: Ghanaians use a mix of global social platforms, but each has a slightly different user base profile:

- Facebook has a broad reach across age groups and is often the entry-point to social media for many. It’s common among 30+ adults as well as youth and is heavily used for local news and community updates. Creators on Facebook can thus reach beyond the “digital native” youth to older audiences.

- WhatsApp is used by virtually everyone with a smartphone; while not a traditional content platform, it’s how content often “goes viral” across demographics, as users forward videos and memes. A funny YouTube clip might get downloaded and shared in dozens of WhatsApp groups, reaching people who might not follow the creator’s channel directly.

- YouTube in Ghana has a strong youth following (teens and twenties) for entertainment and music, but also a segment of 30-50 year-olds who use it for informational content (e.g. watching church sermons, learning DIY skills, or following political discussions on YouTube channels).

- Instagram appeals largely to urban youth and young adults (roughly 18-35 age range). Its user base in Ghana skews slightly more female, given the amount of fashion, beauty, and lifestyle content. It’s also popular among the diaspora and returnee community (Ghanaians who have lived abroad), which means content creators on IG often adopt global aesthetics and trends.

- TikTok is dominated by teenagers and early twenties. It’s the platform where even secondary school students in Ghana have become micro-celebrities. The content is light-hearted and the audience is highly participatory – often dueting videos, imitating dances, and engaging with challenges. TikTok in Ghana is also bringing in users from outside Accra at a notable rate, thanks to its algorithm that can surface anyone’s video, whether you’re in a small village or a big city.

- Twitter (X) in Ghana has a vibrant community of mostly urban, educated youth and professionals who enjoy rapid-fire discussions. The tone is often humorous or advocacy-driven. This platform’s audience values wit and real-time engagement with national issues (e.g. tweeting about football matches or responding to breaking news). It skews a bit male and older relative to TikTok (many users 20-40).

- LinkedIn has a smaller user base in Ghana, mostly professionals in their 20s-40s in industries like finance, tech, and media. However, some “professional influencers” do create career or business-related content here, targeting that niche audience.

It’s worth noting that content consumption is highly multi-platform. A single user might follow a comedian on TikTok, read news from a blogger on Facebook, and watch cooking tutorials on YouTube. Thus, creators often cross-post or maintain presence on multiple platforms to capture these overlapping audiences.

Language and Cultural Influences: English is the official language of Ghana and is widely used in education and media, so a lot of online content is in English – especially content that aims for a broad or international audience. However, local languages and dialects play a huge role in making content relatable:

- Many creators use Akan (Twi) phrases, Pidgin English, and local slang liberally in their videos and posts. This mix, often called “Ghanaian English” or “pidgin,” resonates with young audiences. For example, skits by popular comedians like Teacher Kwadwo or SDK Dele often feature dialogues in Twi or Pidgin that mirror everyday conversations, which makes them highly shareable domestically.

- Cultural humor is a big draw. Influencers incorporate Ghanaian cultural norms, stereotypes between ethnic groups (in a light-hearted way), and trending local jokes. A classic example was the wave of “Azonto” dance videos around 2011-2012 – creators worldwide did it, but Ghanaian dancers garnered attention by adding authentic flair. More recently, TikTok challenges set to Ghanaian songs (like those of artist Black Sherif or viral comedic songs) highlight local culture.

- Diaspora appeal: Some creators consciously produce content that educates or entertains the Ghanaian diaspora. They might use English predominantly and explain local customs, essentially bridging cultures. This is evidenced by channels like Wode Maya’s or Vanessa Kanbi’s (a Ghanaian-British YouTuber) which attract many non-resident Ghanaians curious about life back home. The diaspora audience is important because they often have higher spending power – a factor not lost on brands and creators when considering who they target.

Engagement Behaviors: Ghanaian audiences are highly engaged on social media. They love to comment, share, and partake in trends. A look at any viral post from Ghana will show hundreds of witty comments – commentary culture is strong, especially on Facebook and Instagram. On Twitter, Ghanaians have been known to drive hashtags to global trending (for instance, activism tags like #FixTheCountry in 2021 gained international notice through Ghanaian Twitter). This engagement is a double-edged sword: on one hand it fuels the reach of content (great for creators who can go viral via community amplification), on the other hand, it means creators are under constant public feedback (which can sometimes turn into trolling or intense scrutiny).

Another trend is content as status symbol: Following certain influencers or engaging with certain content has become part of urban youth identity. For example, quoting a joke from a Kwadwo Sheldon video or wearing merch from a popular YouTuber signals one is in tune with the “in-crowd” of Ghanaian internet culture. Brands see this and often capitalize on influencers to shape youth trends (like fashion or slang).

Regional Trends: Within Ghana, different regions show varied content interests:

- In Accra and cosmopolitan settings, there’s interest in cosmopolitan lifestyle content, tech, entrepreneurship, and sophisticated humor that blends local and global references.

- In Ashanti Region (Kumasi and environs), content in Twi has a huge following – e.g. Kumawood movie stars turned YouTubers get strong support from locals. Comedy that pokes fun at the Accra vs. Kumasi rivalry is popular.

- In the Northern Regions, we see emerging influencers who mix English with languages like Dagbani or Hausa, sometimes focusing on issues relevant to those communities (e.g. farming life, northern music and dance).

- The diaspora audience often craves nostalgic or culturally rich content (villages, traditions, food preparation videos, etc.), which some creators provide, effectively making diaspora viewers a significant segment of their audience.

In summary, Ghana’s audience for digital creators is young, active, and culturally rooted. They crave entertaining content, but also rally around voices that reflect their experiences (whether it’s a joke about erratic electricity, or a skit about Ghanaian parents’ strictness). Creators who understand these demographics – balancing English with local language, mixing humor with authenticity, and choosing the right platform for their target age group – tend to succeed in building a loyal following. And as internet access continues to spread outside the big cities, the pool of content consumers (and potential creators) will only grow, bringing even more diversity to what Ghanaians watch and engage with online.

Subscribe to MDBrief

Clean insights, a bit of sarcasm, and zero boring headlines.